XRP Price Prediction: Bullish Technicals and Institutional Momentum Target $3.60

#XRP

- Technical Breakout Potential: Trading above 20-day MA with Bollinger Band expansion suggesting continued upward momentum toward $3.20-$3.30 resistance levels

- Institutional Accumulation: Two-year high in institutional flows and Binance's substantial holdings providing strong fundamental support

- ETF Catalyst Potential: Near-term approval possibilities creating additional upside potential beyond technical targets

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

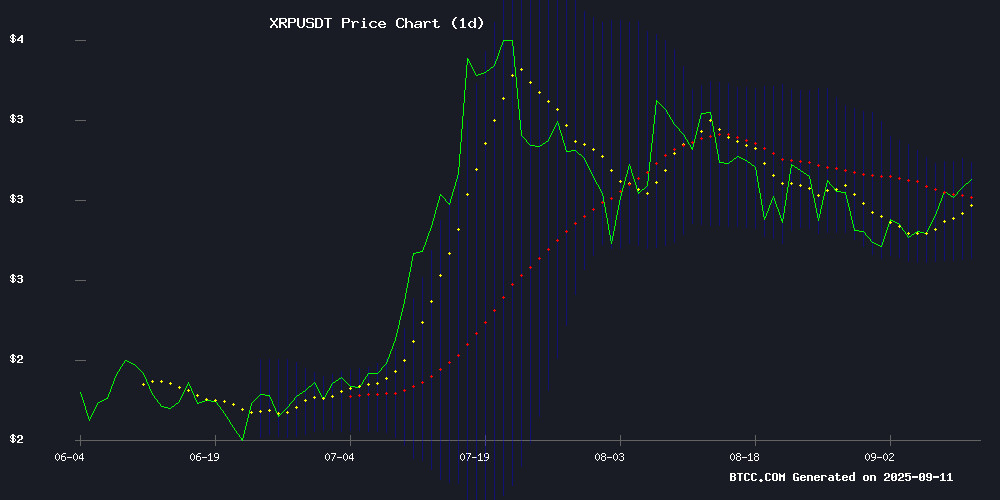

XRP is currently trading at $2.9978, positioned above its 20-day moving average of $2.8977, indicating sustained bullish momentum. The MACD reading of 0.0673 versus the signal line at 0.0955 shows some near-term consolidation, though the negative histogram of -0.0282 suggests potential for short-term pullbacks. The Bollinger Bands configuration, with the price approaching the upper band at $3.0793, indicates strong buying interest. According to BTCC financial analyst John, 'XRP's ability to hold above the 20-day MA while testing upper Bollinger Band resistance demonstrates underlying strength that could target the $3.20-$3.30 range if momentum persists.'

Market Sentiment: Institutional Flows and ETF Prospects Drive XRP Optimism

Current market sentiment for XRP remains predominantly bullish, fueled by institutional accumulation reaching two-year highs and growing anticipation around potential ETF approvals. The surge in exchange reserves during a price rally defies typical bearish expectations, suggesting strong underlying demand. BTCC financial analyst John notes, 'The combination of institutional flows targeting the $3.60 mark and Binance's substantial XRP holdings creates a fundamentally supportive environment. However, validators reverting to version 2.5.1 for stability concerns warrants monitoring for any technical impacts on network performance.'

Factors Influencing XRP's Price

XRP Exchange Reserves Surge Amid Price Rally Defying Bearish Expectations

XRP markets defied conventional wisdom as a 1.2 billion token influx to exchanges coincided with price gains above the critical $3 level. Binance absorbed the lion's share with 610 million XRP deposits, while Bithumb and Bybit similarly expanded reserves dramatically. The token's resilience against typical sell-pressure indicators suggests structural demand shifts.

CME's 74% monthly open interest surge reveals institutional participation heating up alongside retail momentum. Technical charts now paint a bullish picture, with the $4.50 level emerging as a plausible target after Wednesday's 8.43% monthly gain. Market mechanics appear altered as cascading buy orders - including a 3 million XRP market order - override traditional reserve-based selling patterns.

XRP Breakout Fueled by Institutional Flows Targets $3.60 Mark

XRP surged past the $3.00 psychological barrier in a high-volume session, signaling robust institutional interest. The token climbed from $2.96 to $2.99 within 24 hours, with midday breakouts on volumes six times the daily average. Resistance near $3.02 tempered gains, but market structure hints at accumulation, with bulls defending support at $2.98 as traders eye higher extension levels.

The September 10 rally was driven by a volume explosion of 116.7M and 119.0M units in the 12:00–13:00 window, dwarfing the 24-hour average of 48.3M. Futures open interest rose to $7.94B, reflecting heightened derivatives activity alongside spot trading. Analysts identify a descending triangle breakout scenario, with measured targets near $3.60 if momentum holds. Broader risk assets continue to track Federal Reserve expectations, as rate cut bets fuel inflows into large-cap cryptocurrencies.

Price action saw XRP advance 1% within a $0.09 band, peaking at $3.02 during the midday spike before settling near $2.99. The session's final hour tested support at $2.98, but buyers swiftly reclaimed ground, underscoring underlying demand.

XRP ETF Nearing Critical Approval as Investors Strategize for Future Gains

The cryptocurrency market is abuzz with anticipation as the potential approval of an XRP ETF in the U.S. gains traction. Bloomberg analysts peg the likelihood at over 90%, fueling a preemptive rally despite the SEC's final decision not expected until late October. Hybrid products like REX-Osprey, blending ETF and ETN structures, are poised to accelerate capital inflows by launching ahead of regulatory clarity.

Ripple's ecosystem shows divergent momentum—its RLUSD stablecoin has eclipsed $700 million in assets, yet remains predominantly Ethereum-based, diluting its impact on XRP Ledger adoption. The stablecoin arena remains dominated by incumbents like Circle and World Liberty, while XRPL captures less than 2% of the RWA tokenization market, trailing chains such as Avalanche and Stellar. Technical analysts note XRP's $3.30 resistance as a make-or-break level; a breakout could propel it to $3.60, though its modest $100 million TVL suggests limited sustained upside.

Savvy investors are hedging their bets—positioning for an ETF windfall while diversifying into cloud mining platforms like OurCryptoMiner for stable yield. This dual approach reflects the market's delicate balance between speculative fervor and risk management.

XRP Accumulation Hits Two-Year High Amid Bullish Signals

XRP's on-chain accumulation has surged to a two-year peak of 1.7 million tokens, signaling robust investor confidence. Trading at $2.83, the cryptocurrency hovers just below its critical $2.85 resistance level, with analysts eyeing potential breakthroughs to $2.95 or $3.07.

Institutional interest is accelerating, fueled by rumors of spot-based XRP ETFs and a $500 million spike in futures open interest. Hedge funds and whales are accumulating at key support levels, betting on long-term appreciation despite short-term volatility.

Regulatory clarity has emerged as a catalyst—Ripple's $125 million settlement with the SEC resolves a major overhang. The resolution removes a persistent uncertainty that had weighed on XRP holders.

XRP Faces Sluggish Growth as Competitor Emerges in Payments Sector

XRP's price trajectory remains a focal point of debate in crypto markets, with Ripple's flagship asset struggling to shake off its slow-growth narrative. Trading at $3.00 with a 2.34% daily gain, the token reflects broader market lethargy despite commanding a $179.41 billion market cap. Analysts note institutional and retail activity—evidenced by a 15.09% surge in trading volume to $6.54 billion—but caution this may not sustain long-term momentum.

The payments-focused blockchain now faces direct competition from newer networks like Remittix (RTX), dubbed "XRP 2.0" by proponents. These challengers are gaining attention by targeting real-world financial use cases with faster innovation cycles. "Legacy adoption alone won't maintain dominance," observes one trader, pointing to Ripple's steady but unspectacular growth in cross-border remittances.

SitonMining Launches XRP Cloud Mining App to Provide Stable Returns for Holders

SitonMining, a globally recognized mining service platform, has introduced an XRP cloud mining application, offering investors a new avenue for generating stable returns. This development addresses a core concern for XRP holders, who have traditionally relied on secondary market price fluctuations for profits. The app allows users to convert their XRP holdings into mining contracts, enabling passive income without asset liquidation.

The XRP ecosystem, long celebrated for its efficient cross-border payment network, now expands its utility with this mining solution. SitonMining's platform leverages mature infrastructure and robust risk controls, ensuring secure and periodic rewards for participants. Multiple encryption methods and cold wallet mechanisms further safeguard user assets.

Binance Holds Billions in XRP as South Korea Emerges as Key Holder

Binance, the world's largest cryptocurrency exchange, holds between four and five billion XRP, solidifying its position as the second-largest asset on the platform. Nearly 2.9 billion XRP—96% of Binance's total holdings—resides in its main wallet, underscoring the asset's critical role in exchange liquidity and global trading activity.

South Korea has emerged as a pivotal market for XRP, fueled by robust retail and institutional demand. The payments-focused cryptocurrency continues to gain traction, reflecting its resilience despite regulatory challenges like the SEC lawsuit against Ripple.

The scale of Binance's XRP reserves highlights its strategic importance in the crypto ecosystem. As adoption grows, particularly in key markets like South Korea, XRP's influence on global trading volumes appears increasingly entrenched.

RLUSD Stablecoin Gains Traction with 15.8% Volume Surge, Nears $800M Market Cap

Ripple's stablecoin RLUSD is making waves with a 15.8% spike in daily trading volume, pushing its market capitalization to $728.3 million—just $72 million shy of the $800 million milestone. The token recorded $106 million in trades over 24 hours, signaling its rapid ascent in the competitive stablecoin arena. Since its December 2024 launch, RLUSD has added $100 million to its market value in a single month, outpacing the growth trajectories of most rivals.

The stablecoin's velocity is underscored by a 14% volume-to-cap ratio, a metric typically associated with high-utility assets rather than passive collateral tokens. Ripple's strategic infrastructure plays are amplifying RLUSD's adoption: in Africa, it's being integrated into cross-border payment corridors and even climate-insurance payouts tied to agricultural risks. Meanwhile, regulatory approval in Dubai's DIFC grants RLUSD institutional access across 7,000 financial entities, positioning it as a rare hybrid—a compliant dollar stablecoin bridging emerging and mature markets.

XRP Ledger Validators Urged to Revert to Version 2.5.1 Amid Stability Concerns

The XRP Ledger community has issued a critical alert for validators to downgrade from version 2.6.0 to 2.5.1 following the discovery of disruptive technical issues. The problematic update caused memory usage spikes and Boost library conflicts, potentially destabilizing network consensus.

Alloy Networks and validator Vet sounded alarms about version 2.6.0's unreliability, with Ripple confirming 2.5.1 as the stable release. The rollback preserves critical fixes for stalled consensus rounds while eliminating false positives that could compromise ledger integrity.

Network participants face operational risks if they delay the downgrade. The XRPL team emphasizes immediate action to prevent service disruptions, underscoring the importance of validator coordination in maintaining blockchain stability.

Is XRP a good investment?

Based on current technical indicators and market fundamentals, XRP presents a compelling investment opportunity for the near to medium term. The cryptocurrency is trading above key moving averages with strong institutional support and growing adoption metrics.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $2.9978 | Bullish |

| 20-Day MA | $2.8977 | Support Level |

| Bollinger Upper | $3.0793 | Resistance Target |

| MACD | 0.0673 | Consolidating |

The combination of technical strength, institutional accumulation at two-year highs, and potential ETF approval catalysts suggests XRP could test the $3.20-$3.60 range in the coming weeks. However, investors should monitor validator stability concerns and competitive pressures in the payments sector.